This blog has been updated on - July 12, 2023

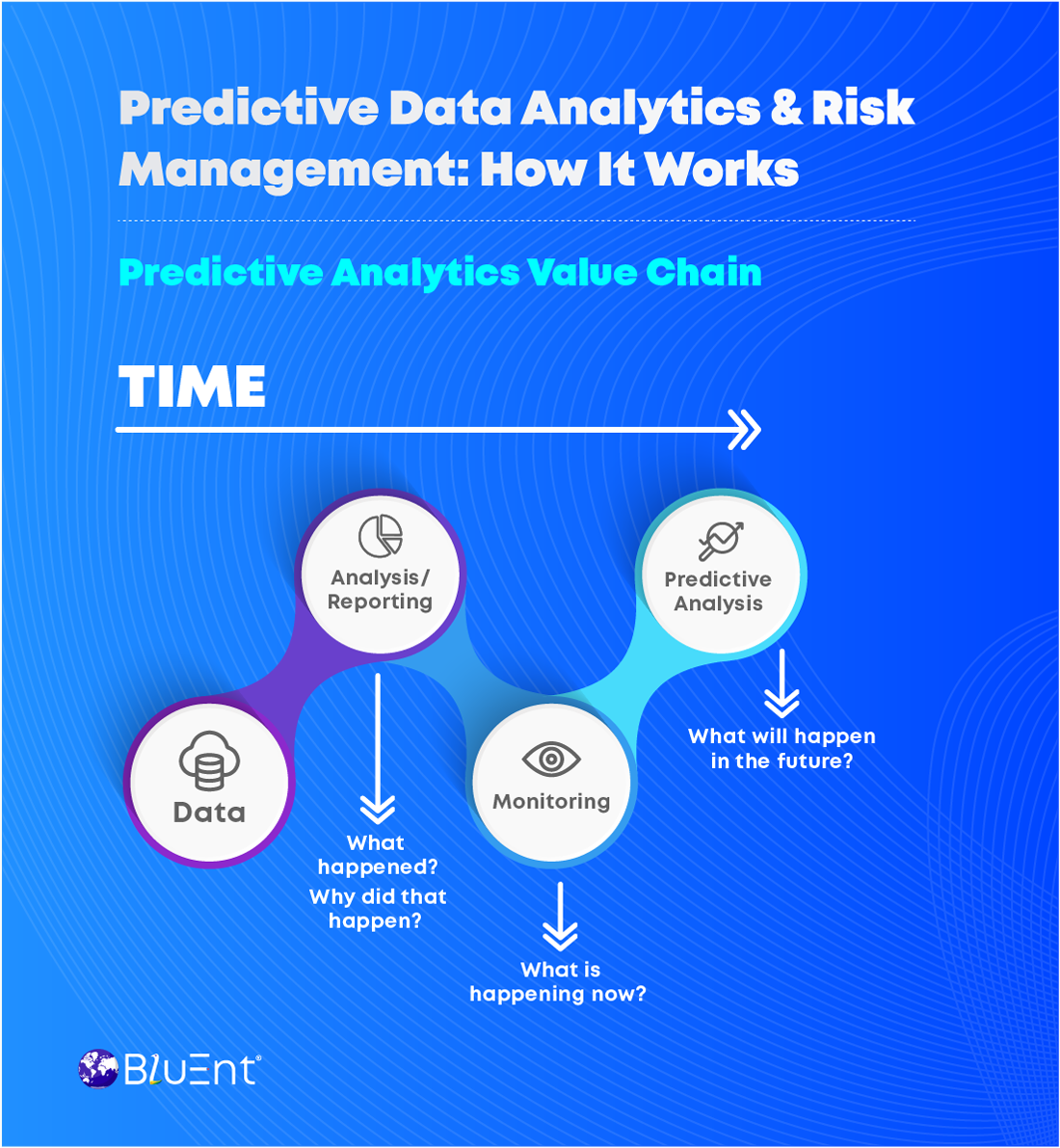

Using predictive analytics for risk management is an inherent part of any business. It's one of the major duties of the decision-makers to start such advanced big data analytics practices for risk mitigation.

Although decision-making has become more accurate with the help of various tools and methods, the vast volume of data in today's world is difficult to manage. That is where predictive analytics for risk management steps in.

A recent report stated that the global risk management market will hit 28.7 billion by 2027. Besides this, the demand for on-premises risk management solutions will be high during that period.

Experts have noted a continued surge in companies turning toward predictive risk analytics for years. Large enterprises from different industries are adopting predictive analytics to identify, analyze, and plan against future business risks.

If your business is facing market uncertainties, then investing in predictive analytics is one of the best steps to take.

Want to learn more? Check out this insightful blog to learn about predictive data analytics, types, benefits, & more.

Table of Contents:

- Predictive Analytics for Risk Management: An Overview

- Types of Risks Your Business Can Identify & Avoid with Predictive Analytics

- How Can Predictive Analytics for Risk Assessment Help Your Business?

- Applications of Predictive Risk Management Solutions

- Get Integrated Risk Management Solutions with Data Analytics Experts at BluEnt

- FAQs

Predictive Analytics for Risk Management: An Overview

Whether your business is large or small, there will be potential risks. For example, a custom software development company might encounter unexpected bugs in a solution without predictive risk management.

What is predictive analytics?

Predictive analytics is a type of data analytics and an emerging branch of advanced analytics. Financial services and banking were among the earliest industries to use predictive analytics for risk management & mitigation.

Today, industries including healthcare, eCommerce, governments, and supply chains use customer data analytics to drive growth profitability & mitigate business challenges.

You can use predictive analytics for your business's risk management through data mining, AI, deep-learning algorithms, machine learning, and data modeling. But what are the kinds of risks you will be encountering?

Let's check them out.

Types of Risks Your Business Can Identify & Avoid with Predictive Analytics

There are many types of business risks that your business can prevent using big data and predictive analytics.

Predictive Analytics for Financial Risk Management

Issues ranging from extended credit, interest rate fluctuations, or the debt load of your business are common financial risks. All these may lead to harm to cash flow or unexpected losses of money or investment.

Conducting predictive data analytics for financial risk management is one of the things your company should be focusing on. Or they can consider getting a guide to financial data analytics.

Financial risk management use cases are not limited to banking and financial institutions. Financial risk assessment is valuable for any industry, including retail, software development, supply chain, manufacturing, insurance and so on.

The United States Treasury Department has recently issued funds for financial risk assessment for the DeFi (Decentralized finance) sector.

Predictive Analytics for Operational Risk Management

That includes unexpected occurrences such as natural disasters, damage to your building, a server outage, or even an employee blunder. It may even be considered a sub-set of financial risk.

Operational risk can be external, internal, or a combination, leading to business continuity and money loss. But big data management and predictive analytics can help you deal with it together.

A recent survey revealed that cyberattacks are the primary influential factors behind rising operational risks among mid-level enterprises and big firms. Hence, you can prioritize cybercrime control in your data analytics and risk management strategy.

Predictive Analytics for Strategic Risk Management

A business plan failing to yield the desired results refers to a strategic risk.

Predictive data analytics and risk management come together to help you catch risks with any strategy or plan which is not working as expected. As a result, the strategy becomes less effective over time.

For example, an email marketing strategy is less likely to work for a retailer that targets different users with different interests instead of focusing on a specific group of customers. The campaign may fail due to a lack of customer research and analysis.

Predictive Analytics for Compliance Risk Management

Another type of risk your business can avoid by implementing predictive analytics for risk management is mandatory regulatory compliance.

There are irregularities in standardized compliance and rules that can cause a major risk to businesses operating in the regulated industry.

At BluEnt, we adhere to HIPAA application development regulatory standards to keep compliance risks at bay.

See how BluEnt's data analytics and insights help enterprises in smart decision-making.

View CasestudyHow Can Predictive Analytics for Risk Assessment Help Your Business?

Predictive analytics with business intelligence helps you develop a risk management and mitigation strategy. That will also identify threats, assets, vulnerabilities that will be pointed out, and other related risks.

That can be done using current data and identifying trends for more accurate decision-making, forecasting, and planning. With predictive analytics, your business can identify opportunities, expose risks and predict outcomes, and act quickly on these.

Predictive analytics for risk assessment can answer questions such as:

-

Will demand for my product drop off next month?

-

How much will we have to spend on overheads?

-

Do we have an estimated revenue for our new product?

-

What will the business' financial mid-period look like?

However, it's not about predicting future events from a clean slate. If your business faces an adverse incident, predictive big data analytics trends can help leaders identify and analyze the root cause.

As a result, businesses can take preventive measures to minimize the risk of such an incident happening again.

It is important to note that predictive analytics for risk management can only be useful if businesses already have a defined risk strategy. You should develop a system with adequate controls to accept or resolve risks.

Applications of Predictive Risk Management Solutions

Predictive analytics uses modern business analytics tools and technologies to predict future challenges and take action against them.

The amazing advantages of predictive risk management are difficult to ignore. Risk assessment analytics share uses cases in many industries, from retail to healthcare, supply chain, manufacturing, and life sciences.

Let's grab some details on industry-wise applications of predictive risk management solutions.

Predictive Risk Analytics in Supply Chain Industry

Predictive analytics can predict supply chain activities. That can help with risk mitigation and fraud detection.

A supply chain has many critical parts and roles; even one disruption can result in unsatisfied customers and lost money. Since customer satisfaction is linked to the timeliness of shipments and deliveries, it is best to have an efficient supply chain.

Hence, many companies invest time and money into supply chain risk management.

Nevertheless, it is important to prepare for the risks that are most likely to happen. One can hire experts for supply chain management & get a backup plan in case of the more unpredictable ones such as the COVID-19 pandemic.

Predictive Risk Analytics in Healthcare

Data analytics in healthcare is proven to improve patients' outcomes.

The reasons why more & more medical facilities are spending on risk analytics solutions are:

-

To collect and compare historical data of the patients & predict their health conditions in the future.

-

To diagnose the root cause of the patient's disease and outline an effective treatment plan against it.

-

To foresee disease outbreaks using advanced healthcare apps and software solutions.

Predictive Risk Analytics in Banking & Finances

Risk management is a need for any financial institution, including banks, insurance companies, loan providers, trading firms, etc.

The risks of financial fraud, scams, cyber threats, and fraudulent claims are common in the financial sector. Hence, deploying predictive data analytics solutions has become imperative for Fintech to prevent the loss of funds and company reputation.

Predictive Risk Analytics in E-commerce

Supply chain predictive analytics is a major aspect of risk management for retail brands. It complements big data to help them improve customer experience and boost sales revenues with effective marketing.

That is how predictive eCommerce companies can use analytics models:

-

To conduct predictive marketing and forecast marketing trends for campaigns, product recommendations, sales, and other metrics. That will involve the role of big data in sales and marketing strategy.

-

To outline a predictive inventory and avoid issues relating to overstocking and running out of stock during peak sales.

Predictive Risk Analytics in the Meteorological Industry

The future of the meteorological industry depends on predictive analytics and big data management.

Almost every weather prediction comes from satellite data and different metrological observations. That's why most weather forecasts are accurate these days.

Data analytics and risk management use cases enable experts to share the latest weather updates and alerts on unfavorable conditions such as heavy rains and cyclones.

Get Integrated Risk Management Solutions with Data Analytics Experts at BluEnt

Integrating risk management solutions through predictive analytics helps organizations learn from past adverse incidents.

We hope this article has given you an insight into how your organization could use predictive analytics for risk management.

Looking for the right consultants for predictive analytics and enterprise data management? BluEnt is the name you can trust to secure your business from future risks and challenges.

Why choose us? We've been catering to global startups, SMEs, and leading corporations for 20 years, and our portfolio reflects the same. Our service offerings include big data analytics and insights, big data implementation, big data management, and predictive analytics.

Want to get in touch for integrated risk management solutions? BluEnt is just a click away.

Frequently Asked Questions

How do you implement predictive data analytics for risk management?

Here are the easy steps to implement predictive risk analytics in your business:

-

List all potential risks in a library before getting started with analysis.

-

Check and test data sources to identify & validate key risk indicators.

-

Automate testing to raise issues directly to the management.

-

Use visualizations to check and evaluate insights against risks.

Keep analyzing and reporting insights regularly.

What are the challenges and limitations of predictive risk management?

Predictive analytics will never completely erase risk or be 100% accurate. With most predictive analytics, the challenges lie in an over-reliance on algorithms that cannot predict human behavior or emotional variables.

Another limitation is that data mining works well for static or linear issues but not for complex ones such as human decision-making.

However, predictive analytics has proven helpful in certain industries or specific applications, especially if the risks are based on facts and certain variables, such as the number of products produced.

For example, predictive analytics can predict the chances of a breakdown of essential equipment. Furthermore, quality assurance models can prevent defects in services and products. The healthcare industry, too, uses predictive analytics to cut costs and improve efficiency.

Fraud Data Analytics: How to Detect and Prevent Fraud Using Data

Fraud Data Analytics: How to Detect and Prevent Fraud Using Data  Risk Analysis & Management: A New Approach to Managing Business Uncertainty

Risk Analysis & Management: A New Approach to Managing Business Uncertainty