The global risk analysis management industry was valued at $39.30 bn in 2022. As per GlobalNewsWire's report, it's projected to increase at a CAGR of 16.64% to reach a revenue share of $64.25 bn in the forecast period of 2022-30.

More & more industries are prioritizing risk analytics and assessment to stay afloat during market changes. It has become so crucial that companies desire to expand their budget for data and predictive analytics investments.

Considering risk analytics as a prime strategy to protect a business from market uncertainties and challenging events is convincing. From startups to big brands, almost every enterprise may need to plan for a data-driven risk prevention plan.

Risk assessment analytics makes sense if you want to future-proof your business from potential risks.

Wondering how? This blog will clear out your doubts with a brief on risk analytics, benefits, types, and how it works.

Let's go ahead.

Table of Contents:

Risk Analysis Management: Intro & Importance

The basic definition of risk analytics and management outlines a technology-driven approach to identifying and managing potential issues using data.

With the blend of big data and next-gen technologies, companies can make accurate forecasts based on insights & mitigate unforeseen hazards beforehand.

Deploying risk analytics is more than necessary for businesses dealing with vast data, including big corporations (healthcare, Fintech, gaming, supply chain & construction), government entities, & NGOs.

The benefits of big data analytics for future trends are not limited to risk identification and prevention. Companies investing in risk analytics will be able to:

-

Evaluate possible issues with predictive risk analytics & management techniques before approving loans or other financial applications and decide whether to proceed.

-

Predict risks that may appear with ongoing projects, business strategies, or investments and cut them by preventive actions. With this, one can keep a balance between risk identification and reduction.

-

Identify business opportunities and determine the profitability of any project undertaken or investment done.

-

Conduct qualitative and quantitative analysis to define uncertainties, execute analysis models, and leverage data solutions.

The increased adoption of data analytics solutions has reduced financial losses and improved business continuity.

Let's review the critical risk assessment and analytics types to include in your business plan.

Types of Risk Analysis & Management Practices

The types of data analytics techniques for risk analysis management are based on the following:

Risk-Benefits Analysis

This type of risk analysis method works like the cost-benefit analysis process, in which a team of data scientists analyzes the benefits of a company's expenses on projects or undertakings.

For instance, a facility using predictive maintenance for fieldwork can perform a risk-benefit analysis to compare the ratio of projected profits to the actual costs of resources consumed to get the same.

If project expenses are higher than profits generated with completion, it's not worthy. Using this data analytics and insights type for risk prevention is the right approach to avoid such failures.

Business Impact Analysis

Business impact analysis is a vital part of any risk assessment plan. The role of this risk analysis type comes when a company suspects the possible hazards with ongoing or upcoming projects.

The process may include top business analytics tools to identify and analyze the possible impact of risks.

One risk analysis example for this type can be understood when a manufacturing facility implements predictive analytics for supply chain risk management, keeping the consequences of avoiding it in mind.

Enterprise Needs Analysis

The purpose of conducting a need analysis is to discover the gaps and loopholes in the existing workflow. That will enable businesses to analyze their impact and get a plan to eliminate them.

Hospitals using predictive analytics in healthcare can detect risks in medical procedures and determine other needs. It helps them pinpoint errors and outline relevant requirements to fix them.

Root Cause Analysis

Big data implementation and analytics strategy also outline root cause analysis for effective risk prevention in a business.

This type of risk assessment technique comes into action when underlying issues in the business procedures remain unnoticed and unfixed. It will involve expert data scientists to deploy the correct set of non-financial & financial analytics solutions for business success.

The primary reason behind getting into root cause analysis is identifying issues that have occurred recently in the past. One can continue with other risk analysis management approaches to forecast and prevent risks in the future.

Recommended Reading:

Wondering how analytics and management help in identifying & preventing risks?

Check out our recent data analytics case study.

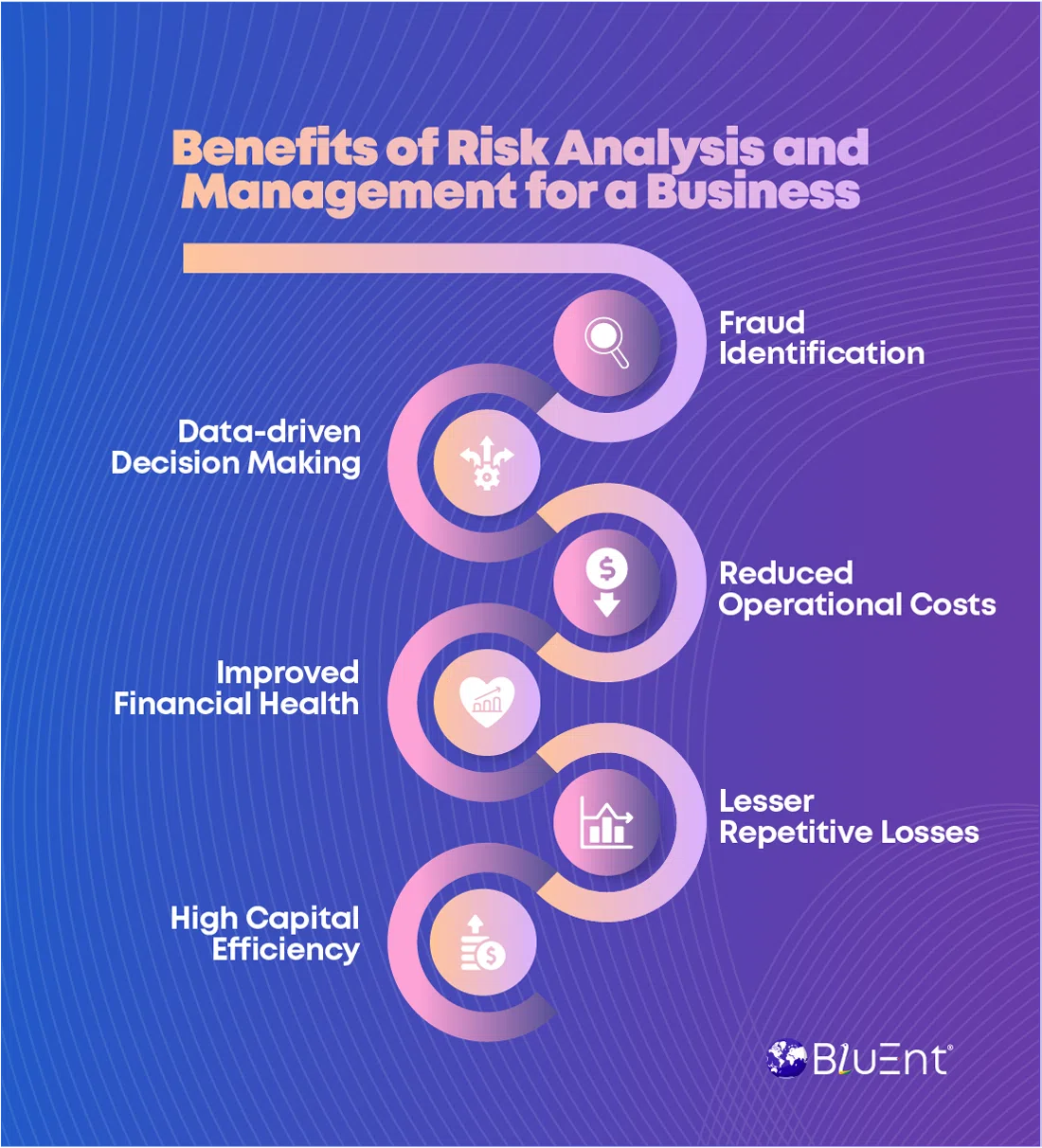

Potential Benefits of Risk Analytics

Risk analytics is a proven practice to forecast potential threats and take decisive actions to mitigate them. Not adhering to enterprise and project risk management needs will refrain you from some significant advantages.

Big data management has many benefits to accessing, managing, and preventing potential business hazards. Let's define them one by one.

Fraud Identification

Enterprises handling many datasets are more prone to financial fraud and security breaches. Risk assessment analysis can reduce such vulnerabilities when combined with advanced AI-driven infrastructure.

Deploying AI and ML-based solutions for systematic risk prevention processes can help detect fraud at every stage of database maintenance & migration.

Data-driven Decision Making

The next benefit of the risk analysis process is intelligent decision-making. Once you get familiar with issues that may occur in the future, you can take the required actions to mitigate them in advance.

Decision-making is one of the significant benefits of applying risk analytics tactics with enterprise data management. It will take your risk mitigation plan to the next level and help you decide which approach is fruitful and which one is risky.

Reduced Operational Costs

Companies depending on enterprise business intelligence can leverage risk analysis management to reduce operating costs like never before.

With risk analysis, businesses can identify issues causing unbearable expenses and plan a strategy to eliminate them without impacting ongoing procedures.

For example, a business analyst can determine & visualize certain cases when a project turns costlier than expected. That will enable stakeholders to adjust their pricing when needed.

Improved Financial Health

Investing in risk analytics can strengthen the financial status of any establishment. The process of BI and analytics takes care of actual project expenses and the budget allotted to execute it.

For instance, a retail business using eCommerce automation can conduct financial data analytics to plan finances for each order before payments. That will let them do precise budgeting before taking orders and manage to deliver them even if customers choose to pay later.

Lesser Repetitive Losses

A risk management framework alerts you about potential issues or challenges in your business. As a result, you will reduce the costs of bearing the loss of funds, resources, efforts, and time.

Also, risk analysis can enhance your business efficiency when used with business process automation tools.

High Capital Efficiency

Risk assessment analytics promises better capital efficiency. Companies can conduct cash flow forecasting besides foreseeing risks affecting their financial status.

With high capital efficiency, businesses can boost their operations and custom software product development practices.

Strategize for a Smart Risk Assessment Analytics Plan with BluEnt's Team

Investing in risk analysis management is lucrative enough to reduce your business loss and enhance profitability. Companies can secure their internal operations, and the environment can perform predictive analytics to increase productivity.

Being a front-runner in business consulting & data analytics, BluEnt is a name one can trust for enterprise data management. Our services range from big data management to big data analytics, big data implementation, & predictive analytics.

With success stories of over 1,100 projects in its portfolio, BluEnt is partnering with top brands, SMEs, and startups worldwide. Our business service offerings include business process management, BI & CRM solutions, enterprise content management, enterprise mobility, & enterprise resource planning.

Want to strengthen your business plans against future risks or uncertainties? Approach BluEnt to make it happen.

Frequently Asked Questions

How can I implement a risk management plan in my business?

Here are a few tips one must consider while implementing risk assessment and analytics solutions:

-

Collect reliable, valuable, and informative data for further analysis.

-

Determine your key goals and trends to match your risk analytics needs.

-

Set the timeline to analyze risks and issues which took place earlier.

-

Get a robust BI setup to visualize and analyze data for risk prevention.

-

Take inputs from the final reports and create an action plan to eliminate risks.

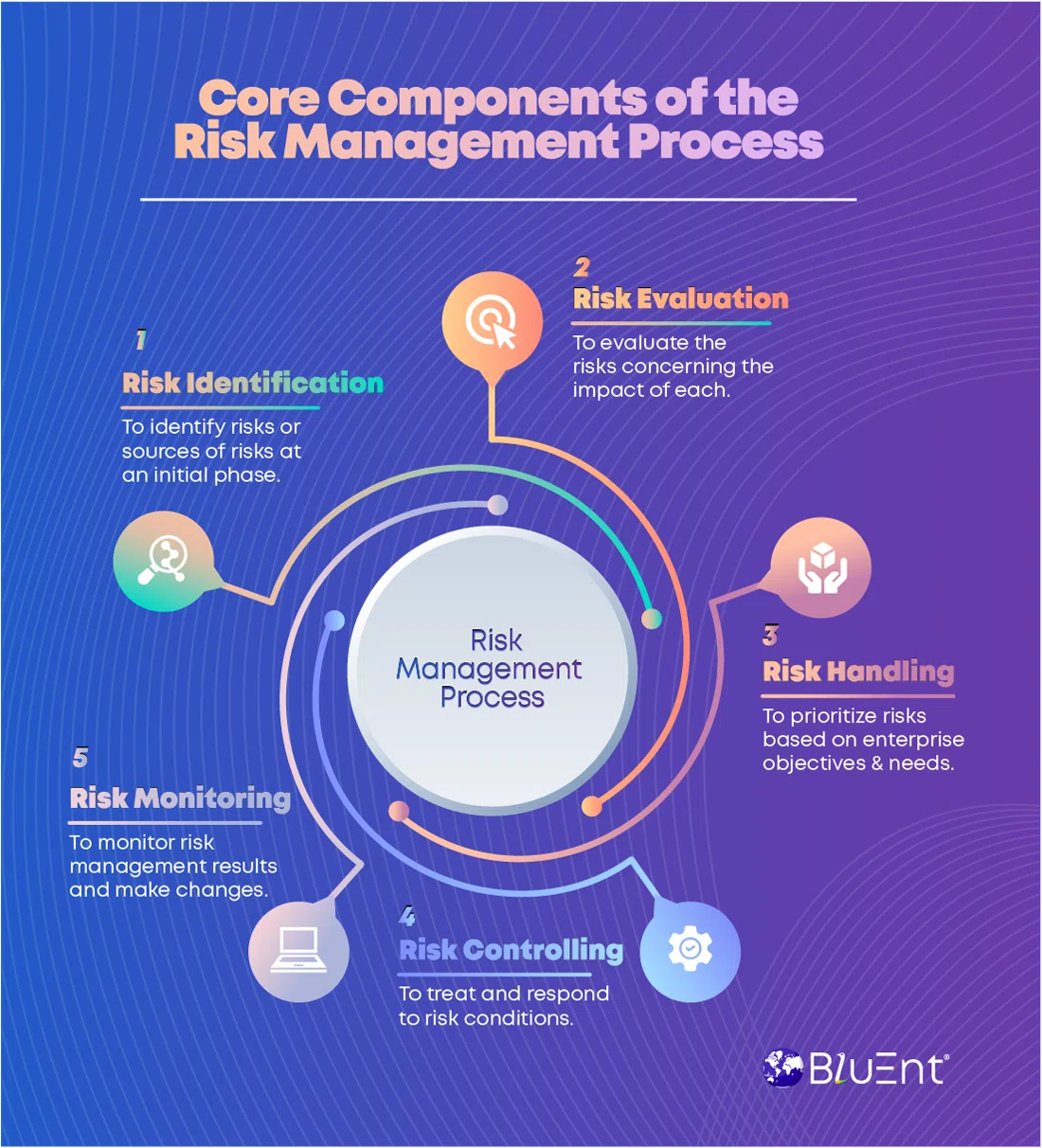

What are the significant components of risk analytics?

The structure of the risk management framework is as follows:

-

Risk assessment to identify existing risks & challenges.

-

Risk management to reduce the impact of risks that have already occurred.

-

Risk communication to address and acknowledge risk across the company.

Fraud Data Analytics: How to Detect and Prevent Fraud Using Data

Fraud Data Analytics: How to Detect and Prevent Fraud Using Data  How to Use Customer Data Analytics to Drive Growth & Profitability

How to Use Customer Data Analytics to Drive Growth & Profitability